PRMIA 8010 - Operational Risk Manager (ORM) Exam

Which of the following data sources are expected to influence operational risk capital under the AMA:

I. Internal Loss Data (ILD)

II. External Loss Data (ELD)

III. Scenario Data (SD)

IV. Business Environment and Internal Control Factors (BEICF)

Which of the following best describes Altman's Z-score

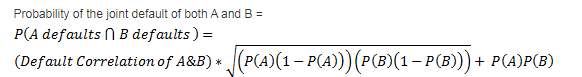

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon. If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

Which of the following statements is true:

I. Basel II requires banks to conduct stress testing in respect of their credit exposures in addition to stress testing for market risk exposures

II. Basel II requires pooled probabilities of default (and not individual PDs for each exposure) to be used for credit risk capital calculations

When compared to a high severity low frequency risk, the operational risk capital requirement for a low severity high frequency risk is likely to be:

A bank holds a portfolio ofcorporate bonds. Corporate bond spreads widen, resulting in a loss of value for the portfolio. This loss arises due to:

Which of the following statements is NOT true in relation to the recent financial crisis of 2007-08?

Which of the following steps are required for computing the total loss distribution for a bank for operational risk once individual UoM level loss distributions have been computed from the underlhying frequency and severity curves:

I. Simulate number of losses based onthe frequency distribution

II. Simulate the dollar value of the losses from the severity distribution

III. Simulate random number from the copula used to model dependence between the UoMs

IV. Compute dependent losses from aggregate distribution curves

The sensitivity (delta) of a portfolio to a single point move in the value of the S&P500 is $100. If the current level of the S&P500 is 2000, and has a one day volatility of 1%, what is the value-at-risk for this portfolio at the 99% confidence and a horizon of 10 days? What is this method of calculating VaR called?

Which of the following statements are true:

I. Credit risk and counterparty risk are synonymous

II. Counterparty risk is the contingent risk from a counterparty's default in derivative transactions

III. Counterparty risk is the risk of a loan default or the risk from moneys lent directly

IV. The exposure at default is difficult to estimate for credit risk as it depends upon market movements