IFSE Institute CIFC - Canadian Investment Funds Course Exam

Sheldon is a 25 year old graphic designer. He has just started working and saves regularly. Apart from his regular salary he also earns extra money from freelancing after office hours and during weekends. His earnings from his freelance work are sufficient for meeting his living expenses. He saves the entire amount of his salary. He has heard about lifecycle funds but has come to you for additional information.

Which of the following statement about lifecycle funds is TRUE?

Which person would be categorized as a vulnerable client?

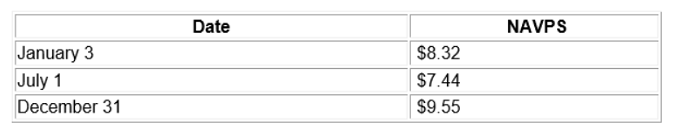

On January 3, John invests $500 in the Blue Sky U.S. Equity Fund. On July 1 of the same year, he invests another $500 into the same mutual fund. Information about the net asset value per unit (NAVPU) at the time of each transaction is provided below. Given this information, what will be the value of John's investment on December 31 of this year (please ignore transaction costs and distributions)?

Jabir begins the registration process with his new dealer Prosper Wealth Inc. Jabir is excited about his new career and eager to start calling clients, opening new accounts, and selling investments. Which of the following CORRECTLY describes when Jabir will be eligible to open new client accounts and sell investments?

Beatrice is looking for comprehensive information regarding the analysis of financial statements and fund management expenses as it relates to her current mutual fund investment.

Which document would provide the information she is looking for?

Jonathan is a Dealing Representative who has just finished an appointment with his new client, Shirley. Jonathan has concluded that Shirley has a low-risk profile but wants to establish additional savings of $500,000. During their discussion, Shirley emphasizes she wants investments that are also tax efficient. Jonathan learned that currently Shirley has no registered retirement savings plan (RRSP) and tax-free savings account (TFSA) contribution room due to using those opportunities by investmenting elsewhere.

What variable is a PRIMARY consideration for Jonathan when making an investment recommendation?

Manuel is a Dealing Representative for Commonwealth Financial Inc., a mutual fund dealer. His dealer represents many different mutual fund families available, including their own: CF Group of Funds. He is

considering recommending a CF equity fund to one of his clients, Stefania. While describing details about the fund, he informs her that accounts are set-up in nominee name, and that their mutual funds are not transferable. In addition, the fund does pay trailer fees.

What type of information has Manuel described about his potential investment recommendation?

Pacari is a Dealing Representative with Cavalry Investments, a mutual fund dealer. Pacari’s client, Darsha, is a long-time customer and an elderly widow. Darsha depended on her husband, for financial decisions before he passed. Pacari has also noticed that Darsha’s capacity seems to be declining over the years. Luckily, with Pacari’s help, Darsha has been managing her finances well. However, Darsha’s daughter has been getting involved recently and has even tried to enter trades without Darsha’s authorization. Pacari is particularly concerned about the last transaction for Darsha’s account: a very large redemption. Pacari fears that Darsha has become a victim of financial exploitation and he raises his concerns with his dealer Cavalry. Which of the following statements about how Cavalry may proceed is CORRECT?

Which of the following best describes implied needs of your clients?

Which of the following is typical for a normal yield curve?