AFP CTP - Certified Treasury Professional

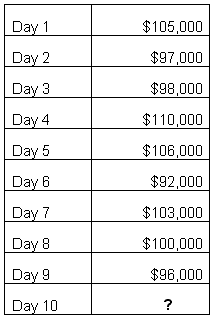

The treasury analyst for XYZ Corporation, a small retailer, is trying to forecast daily cash receipts being swept from the store depository accounts. The analyst has been given the data in the table regarding receipts from the last few days. The analyst chooses to use a seven-day simple moving average forecast methodology.

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

An assistant treasurer discovers that the CFO has been allowing other executives to exercise stock options during blackout periods. What will prevent the assistant treasurer from losing his/her job if he/she reports this discovery?

Upon entering into an interest rate swap with a notional principal of $10,000,000, what is the initial amount of money the counterparties must exchange at the beginning of the swap?

There are 31 calendar days in the month, and the opportunity cost of funds is 9%.

What is the annual cost of float for the batches listed?

If a company uses accrual accounting, deferred taxes are reported on which financial statement?

In capital budgeting, a company might risk adjust which of the following?

Which of the following will directly increase a company's cost in a fee-only bank relationship?

Which of the following MOST often contributes to the misinterpretation of DSO?

Which of the following are KEY issues to be considered when establishing a shared service center (SSC)?

I. Selecting the location

II. Comparing an SSC structure to outsourcing of a process

III. Choosing and implementing the technology for SSC

IV. Choosing the collection bank

Assuming a marginal tax rate of 36%, the taxable equivalent yield for an investment with a tax-exempt yield of 3% would bE.

A company's investment guidelines typically restrict all of the following EXCEPT:

The use of debt to finance a company is called:

The Cash Manager of XYZ Corporation is trying to determine today’s closing cash position in order to make an investment or borrowing decision. The Cash Manager anticipates wiring $55,000 in tax payments and $63,000 in supplier payments today. Additionally, the Cash Manager is aware that a $15,000 wire was received today into the company’s concentration account from a customer and that XYZ Corp. will have to fund a bond interest payment of $200,000 in three days.

Using this information, as well as the data in the table, what is the closing cash position for XYZ Corporation?

A U.S. bank regularly transmits international payments to European based XYZ Bank. The payments flow through an intermediary bank. Recently regulators audited the intermediary bank and discovered the bank may be unknowingly facilitating illegal activities. What payment method was MOST LIKELY used?

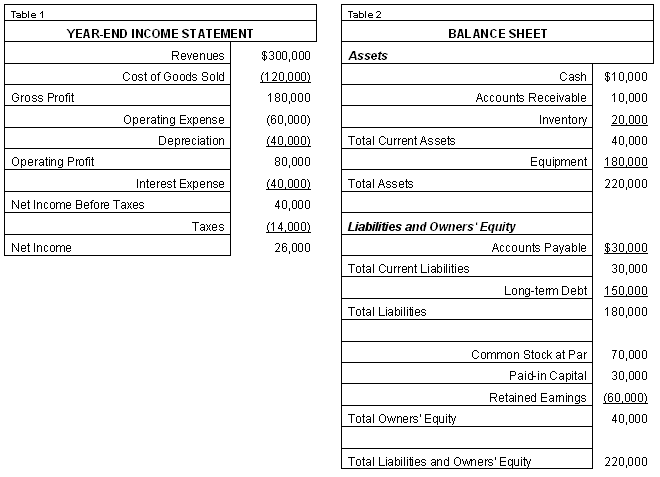

The year-end income statement for a company is presented in Table 1. The balance sheet is presented in Table 2.

What is the company's return on equity?

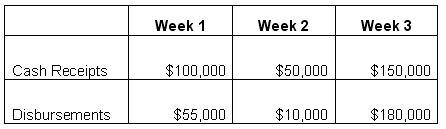

A company has a beginning cash balance of $50,000. Its weekly cash flow forecast shows the following information for the next three weeks.

Which of the following statements is true?

Treasury management systems help cash managers do which of the following?

I. Reduce borrowing expenses

II. Initiate transfers

III. Determine cash position

IV. Obtain account balances

The time between receipt of a mailed payment and the deposit of the payment in the payee's account is known as:

A U.S. company that is expecting to receive a payment of C$1,000,000 purchased a put option of C$1,000,000 at a strike price of 1.75 C$/US$. Two days before the receipt of the payment, the spot rate is 1.85 C$/US$. To maximize its receipt of dollars, the company should do which of the following?

Which of the following can be considered key responsibilities of daily cash management?

I. Overseeing compensation for bank services

II. Management of short-term borrowing and investing

III. Projecting future cash shortages and surpluses