AAFM CWM_LEVEL_2 - Chartered Wealth Manager (CWM) Certification Level II Examination

Section B (2 Mark)

Fifteen Year ago, Sandeep set up his initial allocation in her defined contribution plan by placing an equal amount in each asset class and never changed it. Over time, he increased his contribution by 3 % per year until he reached maximum amount allowed by law. Which of the following biases that Sandeep suffers from?

Section B (2 Mark)

In UK, which of the following types of income is not specifically exempt from income tax?

Section B (2 Mark)

The ________________provides that where the total income of an enterprise is computed by the AO on the basis of the arm's length price as computed by him, the income of the other associated enterprise shall not be recomputed by reason of such determination of arm's length price in the case of the first mentioned enterprise, where the tax has been deducted or such tax was deductible, even if not actually deducted under the provision of chapter VIIB on the amount paid by the first enterprise to the other associate enterprise.

Section A (1 Mark)

A bank that wants to protect itself from higher credit costs due to a decrease in its credit rating might purchase _________________________.

Section C (4 Mark)

Mr. Rajesh Rawat deposits Rs. 15,000 per month at the end of the month for 6.50 years in an account that pays a ROI of 8.80% per annum compounded quarterly. What will be the amount in the account after 6.50 years?

Section B (2 Mark)

Calculate the NOI for an office building with the following information:

Section A (1 Mark)

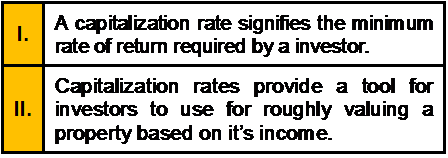

Which of the following statement is/are true?

Section C (4 Mark)

Mr. XYZ is bearish about Nifty and expects it to fall. He sells a Call option with a strike price of Rs. 2600 at a premium of Rs. 154, when the current Nifty is at 2694. If the Nifty stays at 2600 or below, the Call option will not be exercised by the buyer of the Call and Mr. XYZ can retain the entire premium of Rs.154.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2900

• If Nifty closes at 2400

Section B (2 Mark)

An employee benefit plan can generally help in accomplishing all of the following items except:

Section A (1 Mark)

Decision horizon is __________

Section C (4 Mark)

A stock ABC Ltd. is trading at Rs. 450. Mr. XYZ is bullish on the stock. But does not want to invest Rs. 450. He does a Long Combo. He sells a Put option with a strike price Rs. 400 at a premium of Rs. 1.00 and buys a Call Option with a strike price of Rs. 500 at a premium of Rs. 2.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 625

• If ABC Ltd closes at 328

Section A (1 Mark)

The APT is based on the:

Section C (4 Mark)

Suppose Gaurav, an investor, is looking to add to his portfolio and hears about a potential investment through a friend, Hitesh, at a local coffee shop. The conversation goes something like this:

GAURAV: Hi, Hitesh. My portfolio is really suffering right now. I could use a good long-term investment. Any ideas?

HITESH: Well, Gaurav, did you hear about the new IPO [initial public offering] pharmaceutical company called Pharma Growth (PG) that came out last week? PG is a hot new company that should be a great investment. Its president and CEO was a mover and shaker at an Internet company that did great during the tech boom, and she has Pharma Growth growing by leaps and bounds.

GAURAV: No, I didn’t hear about it. Tell me more.

HITESH: Well, the company markets a generic drug sold over the Internet for people with a stomach condition that millions of people have. PG offers online advice on digestion and stomach health, and several Wall Street firms have issued “buy†ratings on the stock.

GAURAV: Wow, sounds like a great investment!

HITESH: Well, I bought some. I think it could do great.

GAURAV: I’ll buy some, too.

Gaurav proceeds to pull out his cell phone, call his broker, and place an order for 100 shares of PG.

Which of the following biases have been exhibited by Gaurav?

Section B (2 Mark)

Select the CORRECT statement regarding basis risk associated with futures.

Section A (1 Mark)

Data for five comparable income properties that sold recently are shown below:

What is the indicated overall rate (RO)?

Section A (1 Mark)

How many states operate lotteries to generate revenue in US?

Section B (2 Mark)

Customer relationship management applications dealing with the analysis of customer data to provide information for improving business performance best describes by which of the following?

Section B (2 Mark)

Mansi needs Rs. 25,000/-, 5 years from now. She would like to make equal payments at the Begin of each year from now onwards into an account that yields annual ROI @ 7 % per annum. What should be her annual payments?

Section C (4 Mark)

Suppose ABC Ltd. is trading at Rs 4500 in June. An investor, Mr. A, shorts Rs 4300 Put by selling a July Put for Rs. 24 while shorting an ABC Ltd. stock. The net credit received by Mr. A is Rs. 4500 + Rs. 24 = Rs. 4524.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 4053

• If ABC Ltd closes at 5025

Section A (1 Mark)

Individuals define risk as:

Section B (2 Mark)

Compute YTM of a bond with par value of Rs.1000/-, carrying a coupon rate of 8% and maturing after 10 years. The bond is currently selling for Rs.850/-.

Section A (1 Mark)

A financial contract that obligates one party to exchange a set of payments it owns for another set of payments owned by another party is called a

Section C (4 Mark)

Two friends Neeraj and Kapil, both belonging to the 33.66% tax bracket, have invested Rs. 10 lakhs in a debt-based scheme. The scheme is a regular run of the mill, assembly line product — nothing extraordinary about it.

The scheme has earned a distributable profit of 12%.

Kapil’s financial condition is not good and due to the business losses his assets are to be auctioned.

Neeraj is working in MNC and getting an annual package of Rs. 18 lakhs. This includes Rs. 270000 as dearness allowance (2/3 forms the part of retirement benefit). He is also earning an agricultural income of Rs. 54000.His expenses are Rs. 80000 per month.

Neeraj has also taken a housing loan in joint name of his wife Anita and himself. Property is also in the joint name and their contribution is equal. Annual outflow towards housing loan in terms of repayment of principal and interest is Rs. 300000. Out of this Rs. 198800 is toward interest.

Neeraj has also invested an equal amount in a portfolio consisting of securities A and B. Standard deviation of A is 12.43%; Standard deviation of B is 16.54%; Correlation coefficient is 0.82

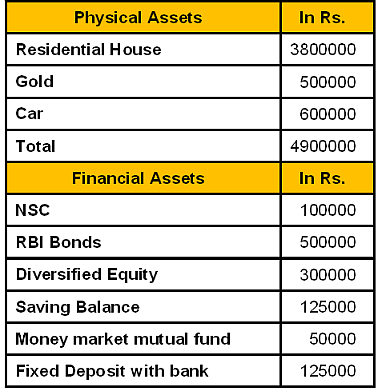

Assets held by Neeraj

Section B (2 Mark)

Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of 13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________.

Section A (1 Mark)

…………………. Is implied in favor of the party creating it

Section A (1 Mark)

Which of the following is NOT one of the phases of the life-cycle theory of asset allocation?

Section C (4 Mark)

Read the senario and answer to the question.

Sajan wants to cover for the expenses of his family without compromising their present lifestyle till the expected life time of Jennifer in case of his untimely death. He consumes 8% of monthly expenses exclusively on self. You advise him that the child plan covers a different goal. Assuming the cover proceeds are invested in a Balanced MF scheme, he should supplement his cover by taking a term insurance for _________ immediately to cover such future expenses. (Please ignore taxes and charges, if applicable, in regular withdrawals from Balanced MF scheme to meet proposed monthly expenses).

Section C (4 Mark)

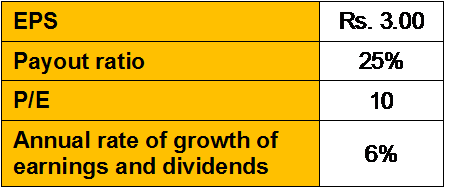

You know the following concerning a common stock:

If you want to earn 10 percent, should you buy this stock? What is the maximum price you should be willing to pay for the stock?

Section B (2 Mark)

The Net Worth Required for an Individual is _________________ for a Partnership Firm is ____________________ and Body Corporate is______________ to fulfil the Capital Adequacy requirements under the SEBI Investment Advisor Regulations 2013.

Section C (4 Mark)

Mr. XYZ is bullish about ABC Ltd stock. He buys ABC Ltd. at current market price of Rs. 4000 on 4th July. To protect against fall in the price of ABC Ltd. (his risk), he buys an ABC Ltd. Put option with a strike price Rs. 3900 (OTM) at a premium of Rs. 143.80 expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 3458

• If ABC Ltd closes at 4352

Section B (2 Mark)

An investor expects the price of a stock to double after eight years. What is the expected annual rate of growth?

Section B (2 Mark)

Mr. Ram buys 100 calls on a stock with a strike of Rs.1,200. He pays a premium of Rs.50/call. A month later the stock trades in the market at Rs.1,300. Upon exercise he will receive __________.

Section C (4 Mark)

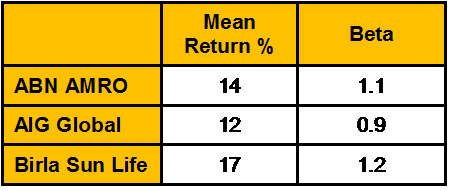

Consider the following information for three mutual funds

Risk free return is 6%. Calculate Treynor measure.

Section A (1 Mark)

Quicker attention and resolution of complaints lead to ________

Section B (2 Mark)

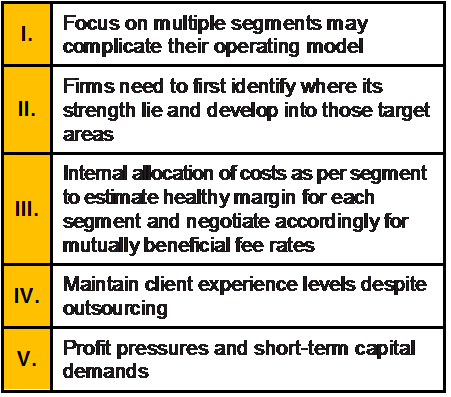

Which of the following is/are the Potential Challenges for wealth management players in India?

Section C (4 Mark)

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

Section A (1 Mark)

A rapidly growing GDP indicates a(n) ______ economy with ______ opportunity for a firm to increase sales.

Section C (4 Mark)

Sunil has an investment portfolio of Rs.100000; the initial portfolio mix is Rs.50000 in stocks, Rs.30000 bonds and Rs.20000 in bank. If market goes up by 10% and the value of bonds decreases by 10%, what should Sunil do under the constant mix policy?

Section A (1 Mark)

__________ is the most important investment decision because it determines the risk-return characteristics of the portfolio.

Section B (2 Mark)

Reliable ltd. has current earnings per share of Rs. 5. Assume a dividend – payout ratio of 50 percent. Earnings grow at a rate of 9 percent per year. If the required rate of return is 14 percent, what is its current value?

Section B (2 Mark)

A collar with a net outlay of approximately zero is an options strategy that

Section B (2 Mark)

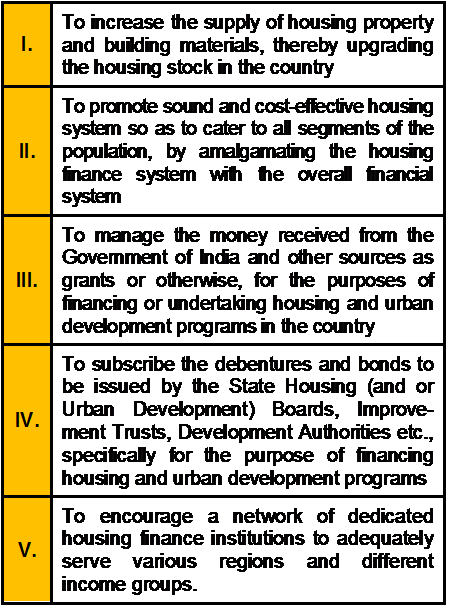

Which of the following are the objectives of National Housing Bank in Indian Real Estate Market?

Section A (1 Mark)

A trough is ________.

Section A (1 Mark)

Endorsements modify

Section A (1 Mark)

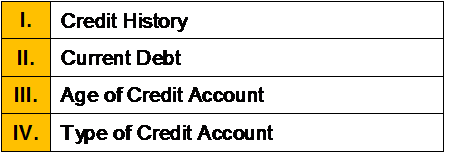

The factors contributing to a Credit Score are :

Section A (1 Mark)

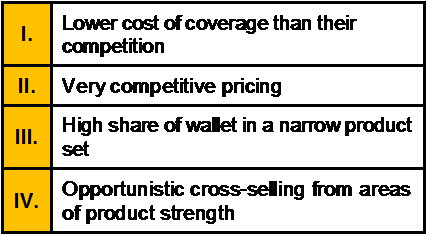

In order to remain competitive, non-core providers need to achieve the following:

Section B (2 Mark)

Lucy purchased a rental house a few years ago for $100,000. Total depreciation to date is $35,000. In the current year, she sells the house for $155,000 and pays $10,000 selling expenses. Calculate Lucy's gain on the sale.

Section A (1 Mark)

Where the return of income is filed after the due date specified u/s 139(1):

Section B (2 Mark)

Which of the following is true with regard to wealth planner’s liability?

Section B (2 Mark)

A bank has a long term relationship with a particular business customer. However, recently the bank has become concerned because of a potential deterioration in the customer's income. In addition, regulators have expressed concerns about the bank's capital position. The business customer has asked for a renewal of its Rs25 million dollar loan with the bank. Which credit derivative can help this situation?