AAFM GLO_CWM_LVL_1 - Chartered Wealth Manager (CWM) Global Examination

Vinod Khanna, aged 27 years, is having a policy of Rs. 15 Lac sum assured and is paying premium of Rs. 14,800/- . The cash surrender value of this policy is at the end of previous year was Rs. 35,000. It is estimated that by this year end, the cash surrender value of this policy would be Rs. 40,000/-. Bonus under this old policy is Rs. 10,000/-.

There is another term insurance policy of Rs. 15 Lac Sum Assured is available to Vinod at Rs. 4,200/- per annum. If rate of interest is 8 % then first calculate the CPT of existing and new policy respectively and then advise Vinod if it is better to continue this policy or to discontinue it?

The management of Pearls India Shopping Ltd has recently announced that expected dividends for the next three years will be as follows:

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

How much amount should be invested by Mr. Batra today to get a maturity value of Rs. 90,368.50 after 6 years, if available ROI is 10% and compounding is Quarterly for first 2 years, Half Yearly for next 2 years and Monthly for last 2 years?

Mr. Chopra runs a Garment Factory, he is very concerned about his retirement and wants you to help him out in planning for it. His Current annual expenses are Rs. 12,00,000 which would be rising at an annual rate of 8% pre- retirement and 2% post retirement. His current age is 50 years and he wants to work till the age of 65. The expected life expectancy in his family is 75 years. Calculate the monthly contribution he must make till his retirement if the pre- retirement returns are 12% p.a. compounded monthly and post-retirement returns are 8% pea compounded annually.?

Mr. Kumar is a 40 year old NRI working abroad for past 5years. He invests Rs. 50, 000/- p.a. for past 5 years and wants to continue until his return to India. He plans to return to India after 10 years from now and enjoy his life back home. Inflation is expected to be 4% for next 30 years and his investment earns 6% interest. His expected life expectancy is 70 years. What would be his corpus at the time of return to India, and what amount he can with draw per month for his household expenses?

Your client, a businessman has a house worth Rs. 2.1 crore and a farm house worth Rs. 85 lakh. His business is worth Rs. 10 crore as per last balance sheet. He has two other partners in the business having stakes of 24% each. He has two cars purchased at Rs. 40 lakh and Rs. 20 lakh, the latter being in personal account. The cars have depreciated/market value at Rs. 30 lakh and Rs. 8 lakh, respectively. His joint Demat account, wife being primary holder, has stocks worth Rs. 1.65 crore. The business has taken Keyman‟s insurance on his life of value Rs. 1.5 crore. He has himself insured his life for an assured sum of Rs. 1.5 crore. You evaluate your client’s estate in case of any exigency with his life as _____.

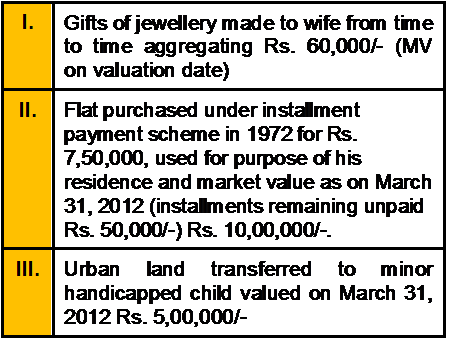

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year 2012-13.

Sunil, aged 33 years, is having a policy of Rs. 1 Lac sum assured and is paying premium of Rs. 1,800/- for the last 10 years. The cash surrender value of this policy is at the end of previous year was Rs. 20,000. It is estimated that by this year end, the cash surrender value of this policy would be Rs. 22,900.

There is another term insurance of sum assured of Rs. 80,000 costs Rs. 300/- per annum which is available to him . If rate of interest is 6%, then first calculate the CPT of existing and new policy respectively and then advise Sunil if it is better to continue this policy or to discontinue it?

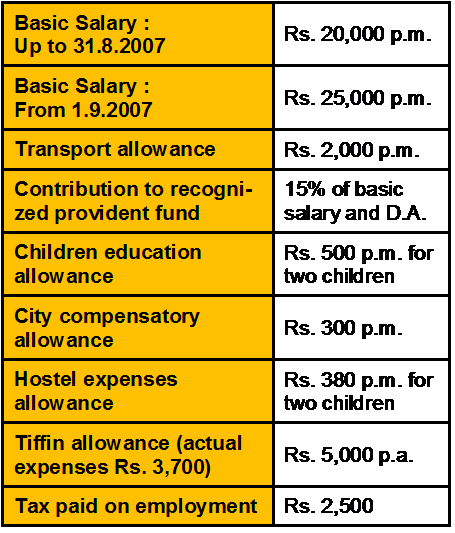

Mr. M is an area manager of M/s Allwin Ltd. During the financial year 2007-08, he gets the following emoluments from his employer:

Compute taxable salary of Mr. M for the Assessment year 2008-09.

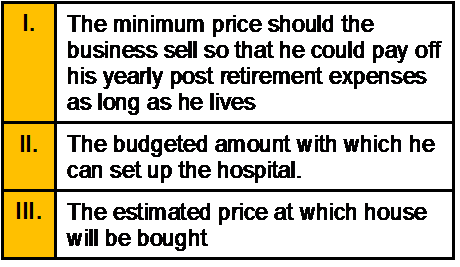

Mr. Bose runs his Handicrafts business. His net proceeds after deducting both the business expenses and living expenses are Rs. 6,00,000 p.a, which will increase at the rate of 5%. He is a bachelor and don’t intend to start any family in future either. Since he don’t have any family obligations, he wants to sell off his business after ten years and buy a home in foothills of Himachal.

He expects to sell the business for a good amount and put 40% of the proceeds in buying the house and setting up a retirement corpus with the rest of amount to pay off his post retirement expenses. He is philanthropic by nature and thus want to save the net revenues from his business to form a charitable hospital for poor people living in Himachal. His current living expenses are Rs. 4,00,000 p.a which will increase in line with inflation. Inflation rate is 3% and interest rate prevailing is 6%.

As a CWM you are required to calculate:

A portfolio manager is considering buying Rs. 1,00,000 worth of Treasury bills for Rs. 96,211 versus Rs. 100,000 worth of commercial paper for Rs. 95,897. Both securities will mature in nine months. How much additional return will the commercial paper generate over the Treasury bills?

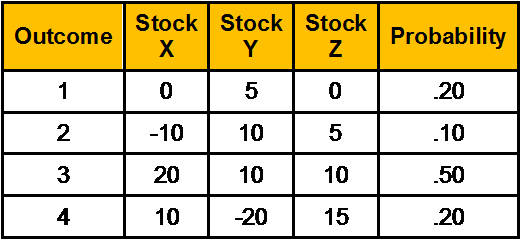

Ashish owns three stocks & has estimated the following joint probability distribution of returns:

Calculate the portfolio’s expected return & standard deviation if Ashish invests 20% in stock X, 50% in stock Y & 30% in stock Z. Assume that each security is completely uncorrelated with the return of other securities.

The list of managing body needs for be fixed with Registrar of Joint Stock companies

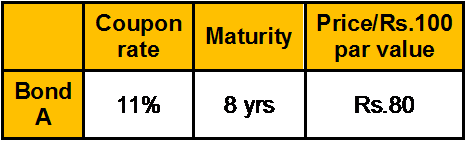

You are considering investing in following bond:

Your income tax rate is 34 percent and your capital gains tax is effectively 10 percent. Capital gains taxes are paid at the time of maturity on the difference between the purchase price and par value. What is your approximate post-tax yield to maturity on this bond?

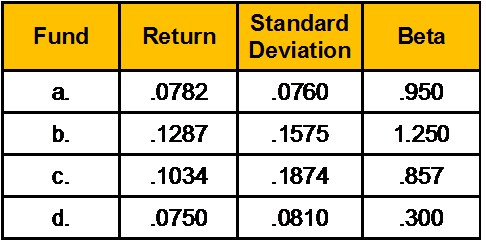

Given the following diversified mutual fund performance data, which fund has the best risk adjusted performance if the risk free rate of return is 5.7%

R purchased a house property for Rs. 26,000 on 10-5-1962. He gets the first floor of the house constructed in 1967-68 by spending Rs. 40,000. He died on 12-9-1978. The property is transferred to Mrs. R by his will. Mrs. R spends Rs. 30,000 and Rs. 26,700 during 1979-80 and 1985-86 respectively for renewals/reconstruction of the property. Mrs. R sells the house property for Rs. 11,50,000 on 15-3-2007, brokerage paid by Mrs. R is Rs. 11,500. The fair market value of the house on 1-4-1981 was Rs. 1,60,000. Find out the amount of capital gain chargeable to tax for the assessment year 2007-08.

Akash owns a piece of land situated in Kolkata ( Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-) On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.75 lakh. And X files an appeal under the Stamp Act and Stamp duty valuation has been reduced to Rs. 4.90 lakh by the Kolkata High Cout. [CII-12-13: 852,11-12: 785,10-11:711]

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy rate throughout the year is 80% and maintenance expenses per year works out to be Rs.3,00,000. Capitalization rate is 12%. Calculate the value of the property?

A businessman sold Rs. 85 lakh value of unlisted securities on 20th December 2012. These shares were acquired in April 2008 for Rs. 20 lakh. He invested Rs. 40 lakh from these proceeds in February 2013 in his first residential house to avail benefit under Section 54F of the Income-tax Act, 1961. What approximate amount of bonds specified under Section 54EC should he purchase and by what date so as to make his capital gains liability almost “Nil†towards these transactions? Cost inflation index for FY 2008-09: 582, 2012-13: 852.