CSI IFC - Investment Funds in Canada (IFC) Exam

A fund manager who utilizes an interest rate anticipation philosophy forecasts a rise in interest rates. What change in asset allocation should he implement?

Calculate the 2-year simple return for the AAA Mutual Fund.

AAA Mutual Fund Performance

Year | Price at Beginning | Distribution | Price at End | Simple 1-Yr Return

1st Year | $10.00 | $0.25 | $11.00 | 12.50%

2nd Year | $11.00 | $0.25 | $10.20 | -5.00%

You are meeting a potential client, William, for the first time. He is a high net worth individual and you are keen to get his business. Which of the following would you consider the most important to create an impressive first impression on your potential client?

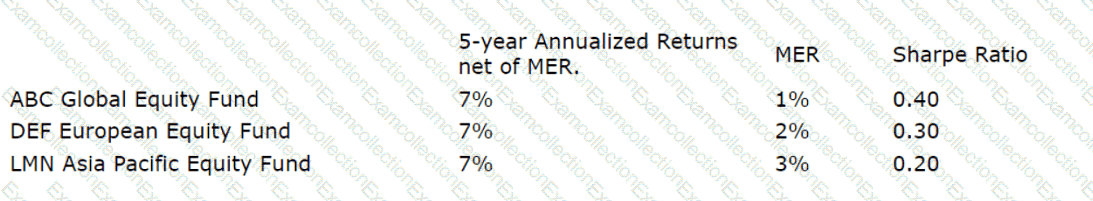

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

What type of risk is the fundamental risk factor for fixed-income securities?

An investor owns equity mutual funds and is concerned about overall fund expenses. She prefers investment options that have lower management expense ratios, along with the opportunity for higher returns. What is the most appropriate fund type for this investor?

Nancy received a $160 taxable dividend from Can-Star Ltd., whose shares she holds in her non-registered account. Can-Star is a taxable Canadian corporation. What is the approximate amount of the dividend tax credit Nancy will receive on the shares?

Frederic recently sold his units in a US dollar (USD) denominated mutual fund. He wants to convert the proceeds back to Canadian dollars (CAD). If he received proceeds of $1,200 USD from the sale and the exchange rate is $1 CAD for $0.99 USD, how much will Frederic receive in Canadian dollars?

Eleanora receives a $500 eligible Canadian dividend from her mutual fund. Her federal marginal tax rate for the year is 29%. Assuming the enhanced gross-up of 38% and a federal dividend tax credit of 15.02%, how much federal tax will she pay on her dividend?

Which type of fixed income fund has a short duration, with the objectives of preserving capital and generating better current income than a money market fund?