PRMIA 8008 - PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition

Which of the following best describes the concept of marginal VaR of an asset in a portfolio:

Under the KMV Moody's approach to credit risk measurement, which of the following expressions describes the expected 'default point' value of assets at which the firm may be expected to default?

The principle underlying the contingent claims approach to measuring credit risk equates the cost of eliminating credit risk for a firm to be equal to:

When performing portfolio stress tests using hypothetical scenarios, which of the following is not generally a challenge for the risk manager?

If A and B be two uncorrelated securities, VaR(A) and VaR(B) be their values-at-risk, then which of the following is true for a portfolio that includes A and B in any proportion. Assume the prices of A and B are log-normally distributed.

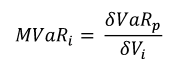

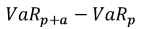

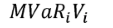

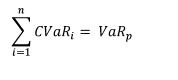

Which of the formulae below describes incremental VaR where a new position 'm' is added to the portfolio? (where p is the portfolio, and V_i is the value of the i-th asset in the portfolio. All other notation and symbols have their usual meaning.)

A)

B)

C)

D)

Which of the following statements are true:

I. Pre-settlement risk is the risk that one of the parties to a contract might default prior to the maturity date or expiry of the contract.

II. Pre-settlement risk can be partly mitigated by providing for early settlement in the agreements between the counterparties.

III. The current exposure from an OTC derivatives contract is equivalent to its current replacement value.

IV. Loan equivalent exposures are calculated even for exposures that are not loans as a practical matter for calculating credit risk exposure.

Which of the following statements is true:

I. Expected credit losses are charged to the unit's P&L while unexpected losses hit risk capital reserves.

II. Credit portfolio loss distributions are symmetrical

III. For a bank holding $10m in face of a defaulted debt that it acquired for $2m, the bank's legal claim in the bankruptcy court will be $10m.

IV. The legal claim in bankruptcy court for an over the counter derivatives contract will be the notional value of the contract.

Fill in the blank in the following sentence:

Principal component analysis (PCA) is a statistical tool to decompose a ____________ matrix into its principal components and is useful in risk management to reduce dimensions.

Financial institutions need to take volatility clustering into account:

I. To avoid taking on an undesirable level of risk

II. To know the right level of capital they need to hold

III. To meet regulatory requirements

IV. To account for mean reversion in returns