CIMA F1 - Financial Reporting

KL has S90.000 of plant and machinery which was acquired on 1 June 20X4. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for 560,000 on 1 June 20X6

Calculate the tax balancing allowance or charge on disposal tor the year ended 31 May 20X7 and state the effect on the taxable profit.

Which of the following is a feature of a direct tax?

Country J is a newly formed independent country and it's accounting professionals are considering adopting international financial reporting standards (IFRS).

Which of the following is a disadvantage to Country J of adopting IFRS as their local generally accepted accounting practice (GAAP)?

Which of the following is a type of short-term finance?

Entity RH has an recognised a taxable profit of $1.Smillion for 20X1'. In Entity RH's resident country. Country M, depreciation charges and entertaining expenses are disallowed expenses. Below is some information on

Entitry RH's outgoings for the period:

Depreciation charged on PPE: $450,000

Political donations: $155,000

Staff parties: $3,200

Cost of updating assets: $10,000

Other expenses: $83,500

In Country M, there is a standard corporation tax of 12% charged on all corporation profits. What is Entity RH's total tax liability for this period?

Which THREE of the following would be included in a cash budget?

XYZ operates in Country P where the tax rules state entertaining costs and accounting depreciation are disallowable for tax purposes.

In year ending 31 March 20X4, XYZ made an accounting profit of $240,000.

Profit included $14,500 of entertaining costs and $5,000 of income exempt from taxation.

XYZ has plant and machinery with accounting depreciation amounting to $26,300 and tax depreciation amounting to $35,200.

Calculate the taxable profit for the year ended 31 March 20X4.

Corporate governance is the means by which an entity is operated and

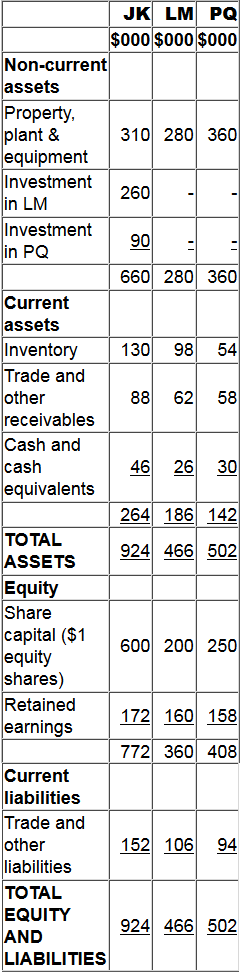

Statements of financial position as at 31 December 20X8 for JK, LM and PQ are as follows:

[1] JK purchased 80% of LM's $1 equity shares on 1 January 20X8 for $260,000 when the retained earnings of JK were $110,000. At that date the non-controlling interest had a fair value of $63,000.

[2] JK purchased 25% of PQ's $1 equity shares on 1 January 20X8 for $90,000 when the retained earnings of PQ were $96,000.

[3] During the year JK sold goods to LM for $32,000 at a mark up of 33.33% on cost. Half of the goods were still in LM's inventory at 31 December 20X8.

[4] LM transferred $32,000 to JK on 30 December 20X8 in settlement of the inter-group trade. JK did not record the cash in its financial records until 2 January 20X9.

Calculate the value of inventory that would be included in JK's consolidated statement of financial position at 31 December 20X8.

Give your answer to the nearest $.

Which of the following correctly identifies the order of the steps involved in the development of an International Financial Reporting Standard prior to it being issued?