CIMA F3 - Financial Strategy

Which THREE of the following statements are true of a money market hedge?

A company is reporting under IFRS 7 Financial Instruments: Disclosures for the first time and the directors are concerned about whether this will lead to the disclosure of information that could affect the company's share price.

The company is based in a country that uses the A$ but 40% of revenue relates to export sales to the USA and priced in US$.Â

Â

When the company reports under IFRS 7 for the first time, the share price is most likely to:

The competition authorities are investigating the takeover of Company Z by a larger company, Company Y.

Both companies are food retailers.Â

The takeover terms involve using a part cash, part share exchange means of payment.

Company Z is resisting the bid, arguing that it undervalues its business, while lobbying extensively among politicians to sway public opinion against the bidder.

Â

Which of the following actions by Company Y is most likely to persuade the competition authorities to approve the acquisition?

A manufacturing company based in Country R. where the currency is the R$, has an objective of maintaining an operating profit margin of at least 10% each year

Relevant data:

• The company makes sales to Country S whose currency is the SS It also makes sales to Country T whose currency is the T$ " All purchases are from Country U whose currency is the US.

• The settlement of an transactions is in the currency of the customer or supplier

Which of the following changes would be most likely to help the company achieve its objective?

Which TWO of the following statements about debt instruments are correct?

Which THREE of the following non-financial objectives would be most appropriate for a listed company in the food retailing industry?

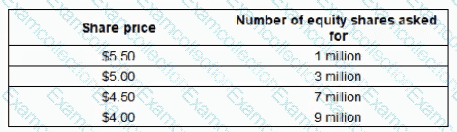

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

Company Z has just completed the all-cash acquisition of Company A.

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Â

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?

A company plans to cut its dividend but is concerned that the share price will fall.  This demonstrates the _____________ effect

Company A has made an offer to acquire Company Z. Â

Both companies are quoted and their current market share prices are:

• Company A - $4

• Company Z - $5

Shareholders in company Z have been given three alternative offers:

• Cash of $5.50 per share

• Share for share exchange on the basis of 3 for 2

• 10.5% long dated bond for every 20 shares

The bond is has a nominal value of $100 and the expected yield on bonds of similar risk is 10%.

Â

You are advising a Company Z shareholder on the three offers.

She requires a 15% premium if she is to accept the offer.Â

Â

In providing your advice, which of the following statements is correct?