CIMA F3 - Financial Strategy

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?

It is now 1 January 20X0.

Company V, a private equity company, is considering the acquisition of 40% of the equity of Company A for a total amount of $15 million.

Company A has been established to develop a new type of engine which will be launched at the end of 20X1. Company A is forecasting that the new engine will result in free cash flows to equity of $2m in its first year of operation and that this will rise by 8% per year for the foreseeable future.

The new engine is the only commercial activity that Company A is involved in.

Company V intends to sell its stake in Company A when the new engine is launched.

Company A has a cost of equity of 12%.

Assuming that Company V receives an amount that reflects the present value of their shares in company A. what is the estimated annual rate of return to Company V from this investment? (To the nearest %)

Company A has agreed to buy all the share capital of Company B.

The Board of Directors of Company A believes that the post-acquisition value of the expanded business can be computed using the "boot-strapping" concept.

Which of the following most accurately describes "boot-strapping" in this context?

A company is concerned about the interest rate that it will be required to pay on a planned bond issue.

It is considering issuing bonds with warrants attached.

Â

Advise the directors which of the following statements about warrants is NOT correct?

A company's current profit before interest and taxation is $1.1 million and it is expected to remain constant for the foreseeable future.

Â

The company has 4 million shares in issue on which the earnings yield is currently 10%. It also has a $2 million bond in issue with a fixed interest rate of 5%.

Â

The corporate income tax rate is 20% and is expected to remain unchanged.

Â

Which of the following is the best estimate of the current share price?

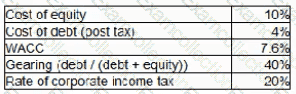

AA is considering changing its capital structure. The following information is currently relevant to AA:

The gearing rating raising the new debt finance will be 50%.

Which THREE of the following statement about the impact of AA’s change in capital structure are true under Modigliani and Miler’s capital structure theory with tax.

A company's Board of Directors wishes to determine a range of values for its equity.

The following information is available:

Estimated net asset values (total asset less total liabilities including borrowings):

• Net book value = $20 million

• Net realisable value = $25 million

• Free cash flows to equity = $3.5 million each year indefinitely, post-tax.

• Cost of equity = 10%

• Weighted Average Cost of Capital = 7%

Advise the Board on reasonable minimum and maximum values for the equity.

An unlisted software development business is to be sold by its founders to a private equity house following the initial development of the software. The business has not yet made a profit but significant profits are expected for the next three years with only negligible profits thereafter. The business owns the freehold of the property from which it operates. However, it is the industry norm to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value (CIV) method for this business?

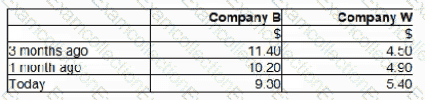

Company W has received an unwelcome takeover bid from Company B. The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition. These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

A company's Board of Directors is considering raising a long-term bank loan incorporating a number of covenants.

The Board members are unsure what loan covenants involve.Â

Â

Which THREE of the following statements regarding loan covenants are true?