CSI IFC - Investment Funds in Canada (IFC) Exam

What type of benefit plan has a final benefit that is dependent on the investment returns within the plan?

At what age must an RRSP be terminated?

An unlicensed person was hired at a securities administrator, and they accepted their first case, which may result in suspending a registrant's license. The new hire immediately requests a subpoena of witnesses (and evidence) and requests guidance from the FATF. What error did the new hire likely commit?

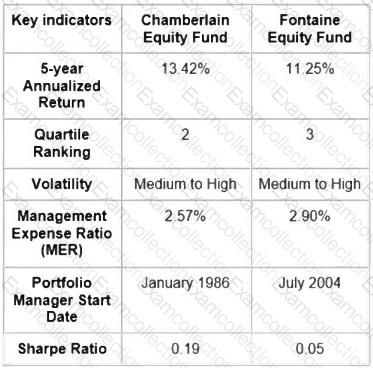

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Based on the financial planning pyramid, what security would be appropriate for a very aggressive investor?

What risk type is prevalent regardless of the level of portfolio diversification or hedging?

What decision accounts for most of the success or failure of a portfolio?

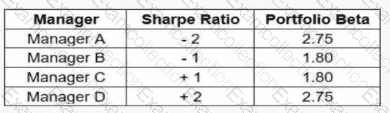

The following chart outlines data for various fund managers:

Which manager likely has the highest return for a given level of risk?

What program requires pensioners to reside in Canada for a specific period of time?

Over the course of a couple of weeks and several appointments, Harold was finally able to provide an investment solution for his new client, Felicia. It was a lump sum investment where they plan to see her

money grow for the next 5 years.

With regards to Know Your Client (KYC) requirements, what are Harold's responsibilities moving forward?