CIMA P3 - Risk Management

Company W produces mobile phone components and has recently tendered for a substantial contract. The results of the tendering process will not become available until three months from now. If the company is successful it will require 2,000 units of a commodity which is currently traded in an open commodity market for $740 per unit. However, there has been speculation that this commodity could increase substantially in price over the next three months and so the company is considering purchasing the commodity now and storing it for three months.

The funds to buy the commodity would be borrowed at an annual interest rate of 7% and the storage cost of the product would be $5.40 per unit per month. The storage costs would be paid at the end of the three month storage period.

Which of the following represents the gain or loss (to the nearest thousand dollars) that will accrue to Company W assuming that the price of the commodity rises to $800 in three months' time?

HBN is a service company that offers cloud-based data storage and management on behalf of clients HBN pays an independent accountancy firm to review its cybersecurity arrangements, conduct penetration tests and report to HBN's Board on the results

Which TWO of the following are correct?

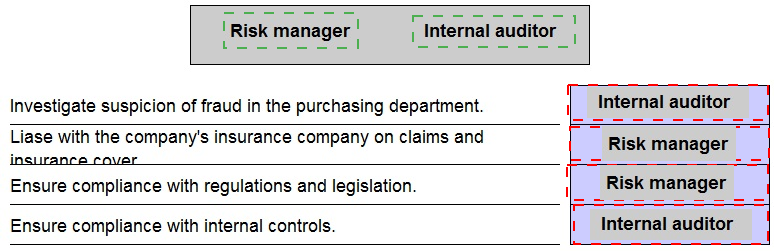

The list below has duties performed by risk managers and internal auditors. Show who would carry out the duties assuming the company has both risk managers and internal auditors.

When a new computer system is being implemented there are several possible methods for managing the changeover from the old system to the new system.

Which THREE of the following are true?

Risk management involves all parties in an organisation.

Which of the following describe the Board's responsibilities for risk management?

Which of the following risks should be given highest priority?

H Ltd is a company providing postal and courier services to small businesses. Customers pay a monthly or annual subscription fee to use the service, plus a very small fee for each item delivered.

A year ago, H employed a new sales team. Their remuneration is dependent on the number of new customers they sign up. Sales increased dramatically in the first six months, but now difficulties are emerging such as new customers dropping their subscription once the initial period has expired; subscriber direct debits being returned unpaid; subscribers going out of business and other similar issues.

Which of the following would be appropriate to help resolve these problems?

Internal audit should be both efficient and effective.

Which THREE of the following measure the efficiency of internal audit"?

MNBÂ is a multinational IT company with headquarters in Asia and with operations in all continents.

MNB is attempting to expand its operations in Europe. This is seen as a major challenge as the European market is very well developed and highly competitive.

MNB develops and manufactures its own products. Parts and assemblies are sourced across Asia, America and Europe. These are sometimes purchased locally as a condition of a contract, but MNB aims to include as much of its own equipment as possible. Transfer prices between MNB's subsidiaries can be set in YEN, USD, EURO, GBP. Transfer prices are revised every month in line with production times as most goods are made on short order with sales cycles running at 3-4 months.

What types of risk are being presented here?

The board of OKN is considering an investment opportunity that will require the company to borrow a large amount in month 10 of the current financial year and to invest it immediately in property, plant and equipment. This investment has a positive net present value that justifies the risk, but the directors are reluctant to invest in the project.

Why might the directors be reluctant?