Pegasystems PEGACPDC25V1 - Certified Pega Decisioning Consultant 25

U+ Bank wants to use Pega Customer Decision Hubâ„¢ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

A telecommunications company is promoting IPhone upgrades with unlimited data plans. The marketing team notices that a customer explicitly stated in a recent survey that they are not interested in iPhone products. The company wants to apply appropriate engagement policy conditions to respect customer preferences.

Which engagement policy condition type should you use to prevent iPhone offers for customers who express disinterest?

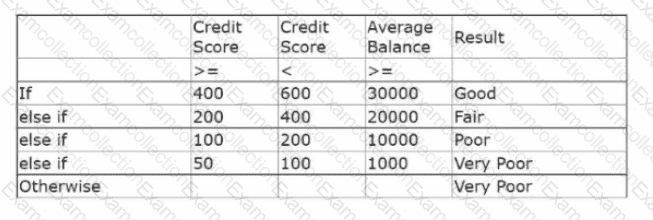

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning architect, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hubâ„¢.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

Regional Bank has a fully implemented 1:1 customer engagement solution that is in the business-as-usual phase. A business user from this bank identifies the need for a new promotional offer for customers who regularly use mobile banking services. The user has detailed requirements including eligibility criteria, treatment messaging, and implementation timeline.

Which process should the business user follow to implement the new action?

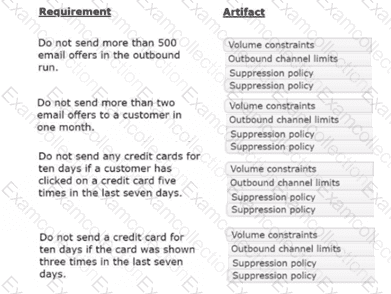

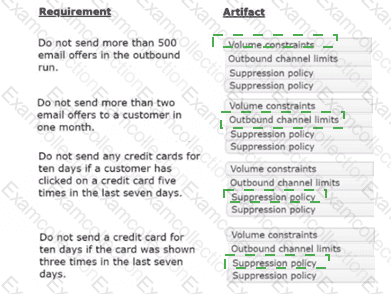

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

GlobalRetail operates in a fast-changing digital marketplace where customer preferences and competitor offers change weekly. Their marketing team struggles with lengthy approval processes that prevent quick responses to market trends, often causing them to miss critical engagement opportunities.

What does agility represent in the context of customer engagement projects?

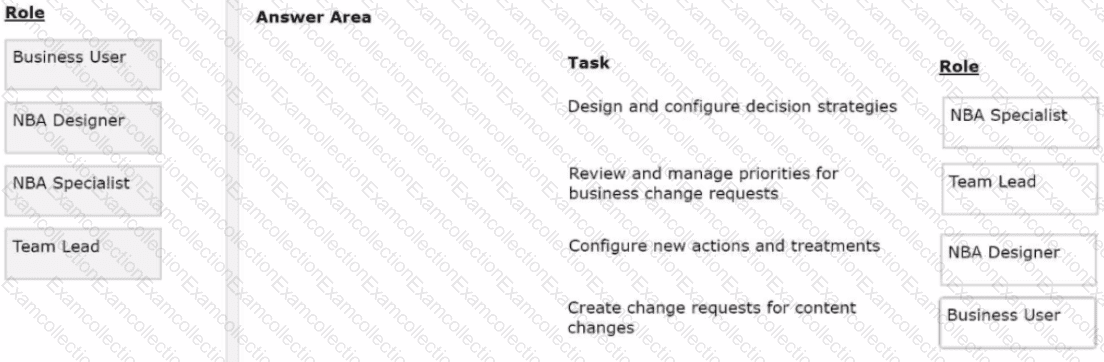

U+ Bank, a retail bank, uses the Business Operations Environment to perform business changes. The team members of the Business Content team and Enterprise Capabilities team perform several roles in the change management process.

Select each role on the left and drag it to the task descriptions to which the role corresponds on the right.

A close-up of a task

AI-generated content may be incorrect.

A close-up of a task

AI-generated content may be incorrect.