Pegasystems PEGACPDC25V1 - Certified Pega Decisioning Consultant 25

As a decisioning architect, you advise the board on the business issues for which they must use the Next-Best-Action strategy. Which three business issues do you recommend? (Choose Three)

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of Pega Customer Decision Hubâ„¢. The bank wants to present the credit card offers through inbound and outbound channels based on the following criteria:

1. Customers must be above the age of 18 to qualify for credit card offers.

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for credit cards.

3. The Platinum Card, one of the credit card offers, is suitable for customers with debt-to-income ratio < 45.

As a decisioning architect, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

What does a dotted line from a "Group By" component to a "Filter" component mean?

U+ Bank, a retail bank, has purchased Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

U+ Bank, a retail bank, is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS. All customers must receive this communication regardless of the engagement policy conditions and constraints.

Which type of communication do you configure to implement this requirement?

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

A financial services organization introduces a new policy that limits each customer to two promotional emails per month. To meet compliance requirements, the implementation team must configure this limit in the Next-Best-Action Designer.

Which configuration steps achieve the desired email frequency limit?

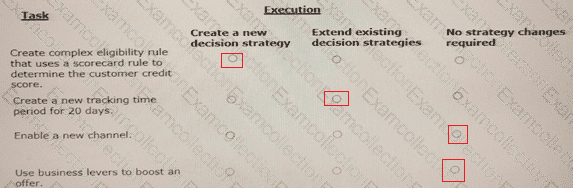

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hubâ„¢. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

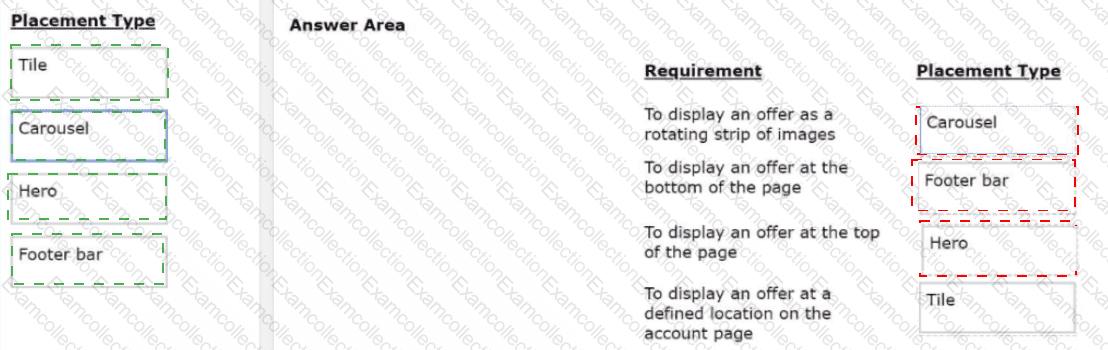

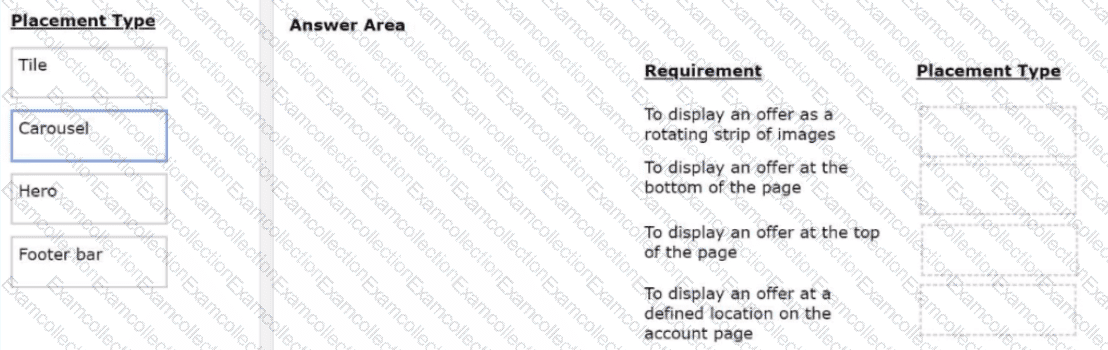

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated