CIMA F1 - Financial Reporting

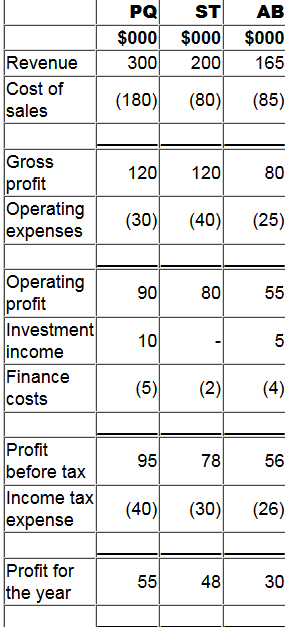

The statement of profit or loss for PQ, ST and AB for the year ended 31 December 20X0 are shown below:

1. PQ acquired 80% of its subsidiary, ST, on 1 January 20X0 and 40% of its associate, AB, on 1 September 20X0.

2. Since acquistion PQ has sold goods to ST and AB for $20,000 and $30,000 respectively. At the year end both ST and AB have 50% of these goods remaining in inventory. PQ uses a mark-up of 20% on all of its sales.

3. Since acquisition the goodwill in respect of ST has been impaired by $8,000 and the investment in AB has been impaired by $2,000.

4. PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ's consolidated statement of profit or loss for the year ended 31 December 20X0?

ST has $20,000 of plant and machinery which was acquired on 1 April 20X0. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for $12,000 on 1 April 20X2.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 March 20X3 and state the effect on the taxable profit.

On 1 May 20X8 DEF enters into a contract to lease plant with a fair value of $200,000. Annual lease payments of $50,000 are to be paid in advance and DEF incurred direct costs to arrange the lease of S2.000 The present value of future lease payments at 1 May 20X8 is $190,000.

What is the amount to be recognised as a right-of-use asset on 1 May 20X8?

In accordance with IFRS 3 Business Combinations, acquisition accounting of an investment in another entity within the consolidated statement of financial position means that the:

EF purchased an asset on 1 September 20X4 for $800,000, exclusive of import duties of $30,000. EF is resident in country Y where indexation is allowed on purchase costs when the asset is disposed of.

EF sold the asset on 31 August 20X9 for $1,500,000 incurring transaction charges of $20,000. The indexation factor increased by 40% in the period from 1 September 20X4 to 31 August 20X9.

Capital gains are taxed at 30%.

What is the tax due on disposal of the asset?

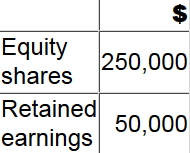

XY acquired 75% of the equity shares of CD on 1 January 20X2 for $230,000.

On 1 January 20X2 CD had the following balances:

XY uses the proportionate share of net assets method to value non controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of CD.

Give your answer to nearest whole number.

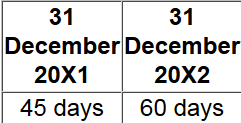

AB has been asked to analyze the receivables days of an entity with a view to improving the working capital cycle.

The following results have been produced for receivable days:

Which of the following is NOT an explanation of why the days have increased?

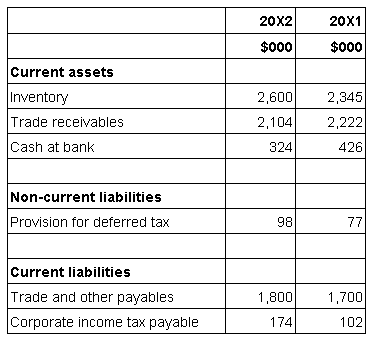

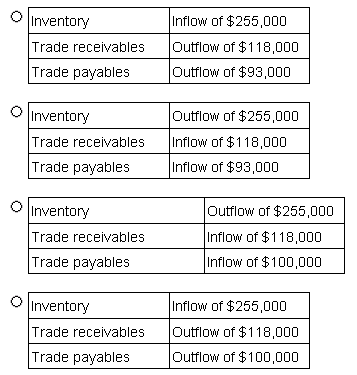

The following information is extracted from OO's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

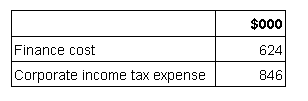

The following information if included within OO's statement of profit or loss for the year ended 31 March 20X2:

Included within finance cost is $124,000 which relates to interest paid on a finance lease. 00 includes finance lease interest within financing activities on its statement of cash flows.________________

Within OO's statement of cash flow for the year ended 31 March 20X2 which figures should be included to reflect the changes in working capital within the net cash flow from operating activities?

XYZ's accounting profit for the last reporting period is $200,000. This is after deduction of:

• Accounting depreciation of $40,000.

• Entertaining expenses of $10,000 which are disallowable for tax purposes

• Directors' salaries of 530.000

Tax depreciation allowances of $60,000 are available and the rate of corporate income tax is 20%.

What is the corporate tax liability of XYZ for the reporting period?

Why are excise duties an attractive method of raising tax for governments?

Select TWO that apply.